The latest global smartphone sales numbers are in, and they paint a stark picture of market consolidation.

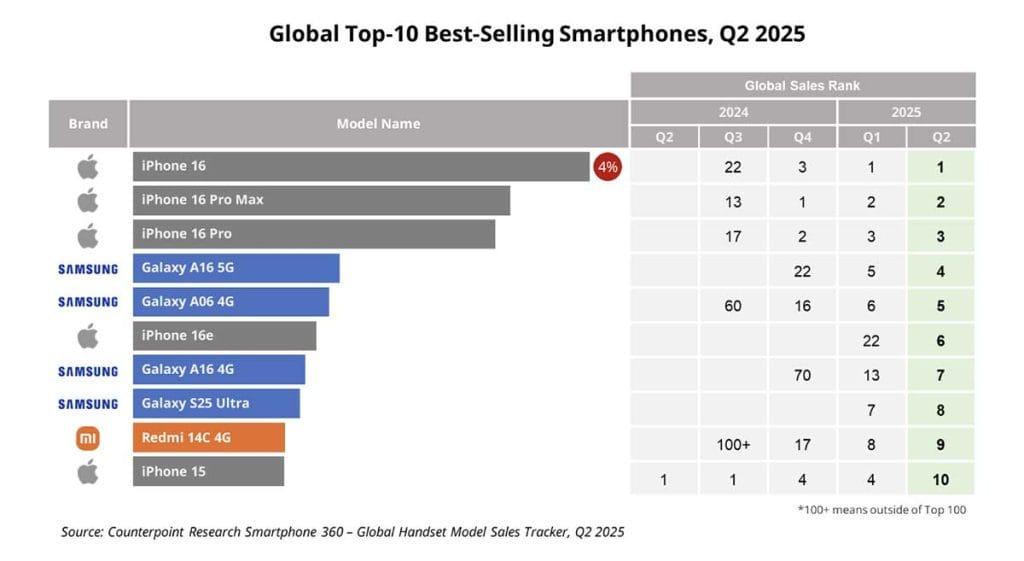

According to data from Counterpoint Research, Apple‘s iPhone 16 was the world’s best-selling smartphone in the second quarter of 2025, single-handedly capturing 4% of the global market. It led a clean sweep of the top three spots, followed by the iPhone 16 Pro Max and iPhone 16 Pro.

The real story of the quarter, however, is the sheer, suffocating dominance that the American technology giant and South Korea’s Samsung exert over the entire market. Together, they command nine of the top 10 spots, leaving just a sliver of room for anyone else.

Apple’s unmatched depth

While the iPhone 16 taking the crown is no surprise, the chart reveals the incredible depth of Apple’s lineup. The company has a staggering six different models in the top 10. This is about an entire ecosystem that buyers are locked into.

The more affordable iPhone 16e made a strong debut at No. 6, finding its niche in cost-sensitive but developed markets like the United States and Japan. Perhaps most impressive is the resilience of 2023’s Apple iPhone 15, which is still clinging to the 10th spot. For a previous-generation device to continue selling in such high volumes is a testament to the brand’s powerful “long tail” and its appeal to buyers who don’t need the absolute latest model.

Samsung’s strategic split

Samsung may have lost the top spots, but it’s winning a different, crucial battle in the budget and midrange trenches. The Samsung Galaxy A16 5G was the top-selling Android phone of the quarter, landing at a very respectable fourth place. Its success formula is simple: deliver solid performance and a key value proposition — up to six years of Android updates — that appeals to practical buyers.

SEE ALSO: Apple still rules premium phones, but HUAWEI, Google, Xiaomi are gaining speed and iPhone 17, Air, Pro, Pro Max: Price, availability, specs comparison

Samsung’s strategy is one of saturation. It secured four spots on the list by blanketing the affordable segment with options, including the even cheaper Galaxy A06 4G and Galaxy A16 4G. In stark contrast, the brand’s only flagship to make the cut was the Galaxy S25 Ultra at No. 8, showing that Samsung’s volume comes from its workhorse A series, not its high-end hero device.

The party crasher

The lone outsider to crash the party was Xiaomi. Its Redmi 14C 4G clawed its way into the ninth spot, a remarkable achievement for a model that was ranked outside the top 100 just a few quarters ago. Its success in emerging markets like Latin America and the Middle East shows it’s possible to compete, but only by staying laser-focused on the ultrabudget segment.

Ultimately, the Q2 2025 chart is a story of consolidation. For consumers, the choice at the top is overwhelmingly Apple, while the go-to for an affordable Android is Samsung. The question heading into the second half of the year is whether any other brand has what it takes to break this stranglehold.

Share this Post