The tablet market just pulled off something of a post-pandemic miracle. According to the latest data from Omdia, global tablet shipments climbed nearly 10% in 2025, reaching 162 million units. It’s the kind of momentum we haven’t seen since 2020, when everyone was panic-buying iPads to survive remote work and Zoom school.

But while the numbers look shiny, there’s a “winter is coming” vibe beneath the surface. With memory prices set to skyrocket and AI features emerging as the new battleground, the landscape for the world’s biggest tablet makers is shifting quickly.

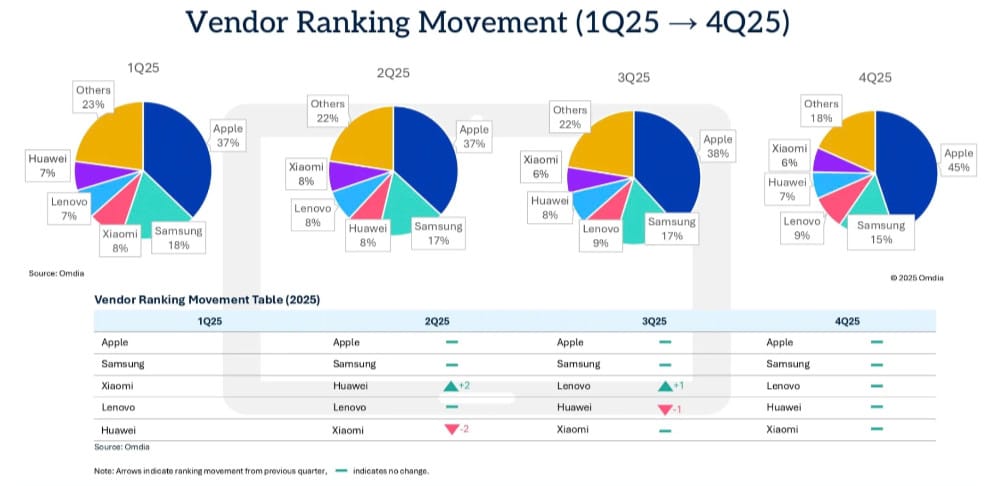

Here’s how the heavy hitters stacked up as we head into an uncertain 2026.

Apple: The king stays king

Apple didn’t just join the recovery; the Cupertino giant led it. Shipping 19.6 million iPads in Q4 alone, a 16.5% jump, Apple proved the iPad remains the default choice for most people.

The growth was a two-pronged attack: the approachable iPad 11th Generation handled the volume, while the M5-powered iPad Pro lineup captured the high-end creative market. Perhaps the most interesting development for Apple isn’t hardware, though. Its collaboration with Google to bring Gemini into the Apple Intelligence ecosystem suggests that even Apple knows it can’t win the AI war in a vacuum.

Lenovo: The comeback kid

If there were a “Most Improved” award for 2025, it would go to Lenovo. It posted a massive 36% growth in shipments during the final quarter.

Lenovo’s strategy was savvy: It ramped up shipments early to get ahead of the expected price hikes in the memory market. But it is also playing the long game with software. The company’s “Qira” platform, which attempts to bridge the gap between Windows and Android, is a direct answer to a long-standing tablet complaint: “Why can’t my tablet just act like my laptop?”

Samsung: Feeling the squeeze

It wasn’t all champagne and celebrations. Samsung, despite holding onto the No. 2 spot globally, posted a 9.2% dip in shipments during the fourth quarter.

While the Galaxy Tab S series remains the gold standard for Android tablets, the South Korean manufacturer is feeling the pressure of a bifurcated market. On one side, Apple dominates the premium tier; on the other, aggressive Chinese brands such as Xiaomi are eating into the midrange. To bounce back, Samsung will likely need to double down on foldables and multi-device productivity features that Apple still hasn’t touched.

The rising challengers: HUAWEI and Xiaomi

The “other” category is becoming a force to be reckoned with. HUAWEI grew 14.8%, proving its resilience in the face of ongoing supply chain hurdles. Xiaomi‘s full-year shipments jumped by a staggering 25%.

These brands are no longer just alternatives. They are shipping high-refresh-rate screens and competitive styluses at price points that make the base-model iPad look dated.

What’s next: The AI pivot

The 2025 boom was largely driven by refresh cycles — people replacing the tablets they bought in 2020. As we move into 2026, Omdia warns the market will likely slow.

The new must-have feature won’t just be a thinner screen; it will be on-device AI. As vendors move toward ecosystem-centric devices, your next tablet won’t just be a screen for Netflix but an AI-driven hub designed to cut friction between your smartphone and your PC.

The hardware is getting faster, but the software is finally getting smarter. The question is: Are you ready to upgrade again?

If you’ve been eyeing a new tablet, it may be wise to buy sooner rather than later, as memory constraints are expected to drive up retail prices by mid-2026. At the same time, 2026 is shaping up to be the year of AI-driven experiences, but if chatbots or automated photo editing aren’t priorities for you, 2025’s older models currently offer the best value. In addition, emerging markets are fueling a surge in education-sector tablets, which means more durable and affordable options are beginning to hit the secondary market.