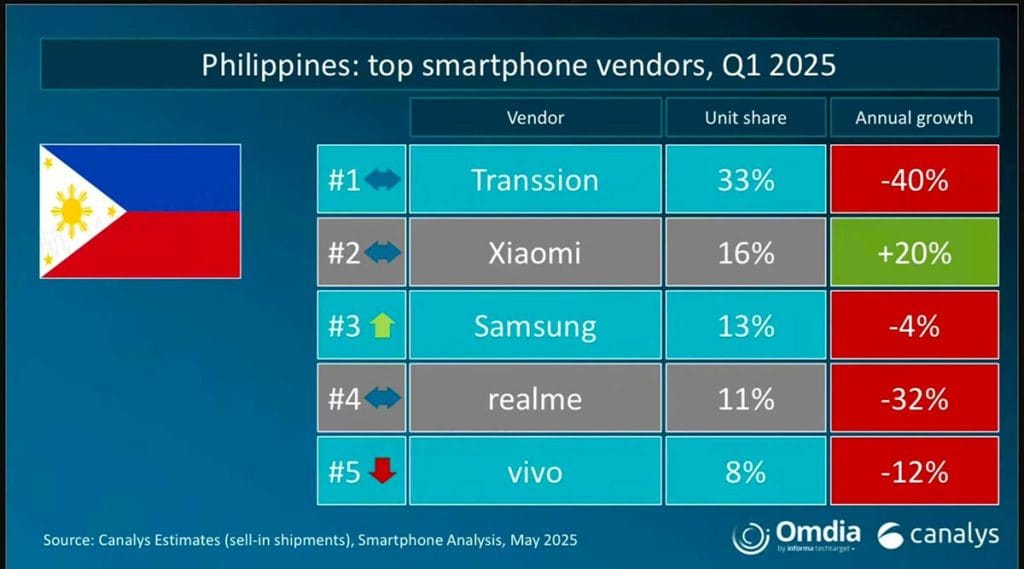

The Philippine smartphone market experienced a turbulent start to 2025, marked by overall contraction and a dramatic reshuffling of vendor rankings. While the first quarter of 2025 saw most major players facing declining shipments, Xiaomi managed to buck the trend with significant positive momentum.

According to the latest data from market-research firm Canalys, the first quarter painted a challenging picture. TECNO, Infinix, and Itel‘s mother company, Transsion, while retaining the top spot with 33% of the market share, saw its annual growth plummet by 40%. Samsung captured 13% of the market but was down 4% year-on-year, while realme held 11% amidst a sharp 32% decline. vivo rounded out the top five with 8%, experiencing a 12% drop.

This landscape is notably different from just the previous period. In the fourth quarter of 2024, Transsion also led with a slightly higher 34% share. Xiaomi was close behind at 15%, tied with vivo. However, by Q1 2025, Xiaomi increased its share to 16%, solidifying its position at No. 2 with a robust 20% annual growth — a stark contrast to its competitors. vivo, meanwhile, saw a dip from 15% to 8%, falling to fifth place. OPPO, which held a 10% share in Q4 2024, dropped out of the top five last quarter, while Samsung moved into the third spot.

Southeast Asia’s smartphone shipments up 11% in 2024 as OPPO takes lead for first time

— Canalys (@Canalys) February 11, 2025

The market rebounded in 2024, with vendors shipping 96.7 million units – up 11% year on year after two years of decline.

Read the full report – https://t.co/MBPHRGVMKH pic.twitter.com/6twbfYJPp5

Smartphone vendors’ performance in Q4 2024

Share this Post