In an age where our lives increasingly play out online, from daily food deliveries to monthly streaming binges, the promise of getting cashback on those everyday transactions is a major draw. CIMB Bank Philippines is making that promise a reality with its new virtual debit card, designed not just for convenience and security, but to put more money back in your pocket.

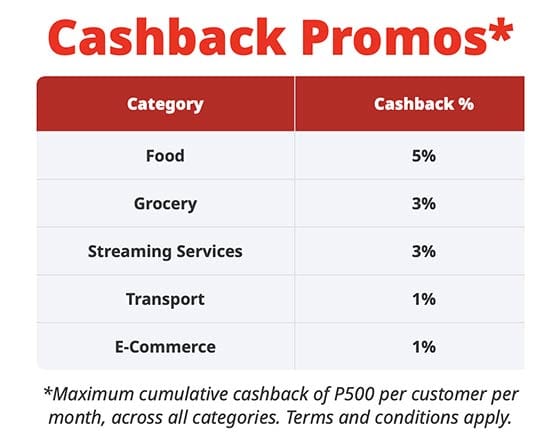

With the CIMB virtual debit card, you can earn real, significant rewards on your most frequent digital buys. Imagine getting 5% cashback on those essential food deliveries, making your next meal a little lighter on your budget. Your routine online grocery runs become more rewarding with 3% cashback, and even your entertainment gets a boost with 3% cashback on streaming services. For your daily commutes via ride-hailing apps and all your general e-commerce purchases from platforms like Lazada and Shopee, you’ll still net a solid 1% cashback.

This is an incentive running until December 31, 2025. Plus, with a generous P500 (almost $9) monthly cap that resets every month, consistent use of this virtual card can lead to substantial savings on spending you’re already doing, without having to jump through hoops or change your existing online habits.

The benefits extend beyond just cashback, though. The CIMB virtual debit card is a thoughtful answer to the common pain points of online transactions, wrapped up in a user-friendly package. It’s the digital twin to your physical debit card, but with a critical distinction: It exists only within your CIMB Bank PH app. This means it has its own unique card number, expiry date, and CVV, separate from your main physical card. Why does this matter?

- Enhanced security: Your primary bank account details stay protected. If an online merchant is compromised, only your virtual card info is exposed, and you can instantly block or replace it in the app without affecting your main account.

- Convenience: Activate it in a few taps within the CIMB app — no paperwork or waiting. Link it to any active CIMB deposit account, like your UpSave or GSave, for flexible use.

- Control: Manage your virtual card directly from your smartphone. Instantly lock the card to pause spending, or adjust transaction limits as needed.

How to get started with your CIMB virtual debit card

Getting set up is straightforward. If you’re already a CIMB Bank PH customer with an active deposit account, you’re halfway there.

- Log in to the CIMB Bank PH mobile app. If you don’t have it yet, download it from your app store.

- Tap on the “Card” icon at the bottom of the screen.

- Select “Request a Card” and then choose “Virtual.”

- Read and accept the terms and conditions.

- Pick your preferred virtual debit card color. Because why not?

- Finally, select the CIMB Bank PH deposit account you wish to link to your new virtual card. And just like that, you’re ready to go.

For any Filipino regularly engaging in online transactions, the CIMB virtual debit card seems like a practical enhancement to your digital financial toolkit. It simplifies security, offers unparalleled control, and provides tangible rewards for the spending you’re already doing.

Share this Post