A new report shows more people are buying high-end phones than ever, and the real action is happening just below Apple‘s throne.

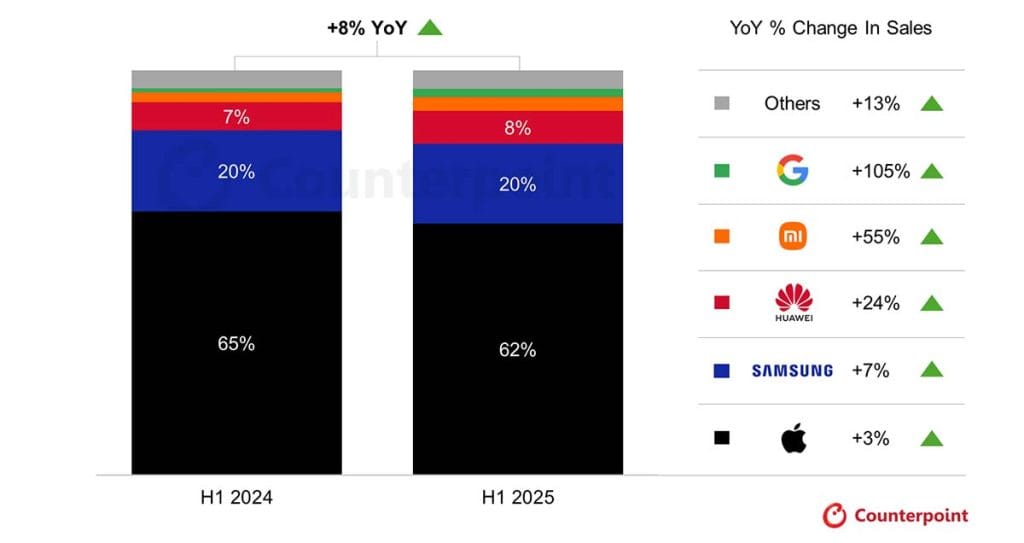

The smartphone market is going high-end. According to a new report and data from Counterpoint Research, sales of premium smartphones — or those costing over $600 (roughly P34,050 in Philippine pesos) — grew 8% year-over-year in the first half of 2025, hitting a record high and massively outpacing the overall market. In plain English, people are willing to spend more on their handsets, and this high-end slice of the pie now accounts for a staggering 60% of the industry’s total revenue.

Apple, unsurprisingly, is still the king of this lucrative hill, commanding a massive 62% of the premium market. But that number, down from 65% a year ago, hints at the real story: The most interesting moves are coming from the challengers, who are finding new and frankly fascinating ways to chip away at the iPhone’s dominance.

SEE ALSO: Top 10 best-selling smartphones of Q2 2025: Apple, Samsung leave little room for rivals

While the American technology giant’s lead is enormous, its growth has slowed to just 3%. The data shows its position is being eroded, particularly in China, by a resurgent HUAWEI. Bolstered by a loyal domestic base and unique hardware flexes like its tri-folding Mate XT, HUAWEI isn’t just a regional player; it grew its global premium share to 8% on the back of 24% YoY sales growth, solidifying its position as a significant global competitor.

Meanwhile, after years of trying, Google has finally cracked the code. For the first time in five years, it has broken into the top five premium brands, with its sales exploding by 105% YoY. The success is being driven by the Pixel 9 series, but the strategy behind it is what’s key. Instead of just fighting a specs war, Google is leaning hard into what makes it unique: AI. By positioning the Pixel as an AI-first device, it’s building a brand that stands for smarts over raw hardware, and it seems consumers are finally buying in.

Perhaps the wildest growth story comes from Xiaomi, which saw its premium sales skyrocket by 55%. The catalyst? A car. Counterpoint notes that the “halo effect” of the company’s wildly popular Xiaomi SU7 electric vehicle is directly benefiting its smartphone business. This is a masterclass in brand elevation. By launching a desirable, high-tech EV, Xiaomi has transformed its image from a maker of budget-friendly gadgets to a legitimate premium tech powerhouse.

And what about Samsung? The perennial No. 2 held its ground with a steady 20% market share, growing a healthy 7% YoY thanks to a strong performance from the Samsung Galaxy S25 series. The South Korean manufacturer continues to be the standard-bearer for the foldable category, a niche that Counterpoint says is still growing and serves as a key differentiator.

The takeaway from the first half of 2025 is clear: The premium smartphone battle is no longer just about specs. The new frontiers are AI and form factor. The report highlights that GenAI-capable devices already make up over 80% of premium sales, signaling a massive shift in what consumers expect from a high-end phone.

For now, foldables remain a key differentiator for Android brands. But that might not last forever. The report concludes with an intriguing note: Apple’s rumored entry into the foldable market in 2026 is expected to grow the entire segment, setting the stage for the next major showdown in the world of premium tech.

Share this Post