Stop looking at the shiny new flagships for the whole story. The real, high-octane action in the global smartphone market isn’t happening in a pristine Apple Store or a high-end carrier showroom; it’s happening in the resale aisle.

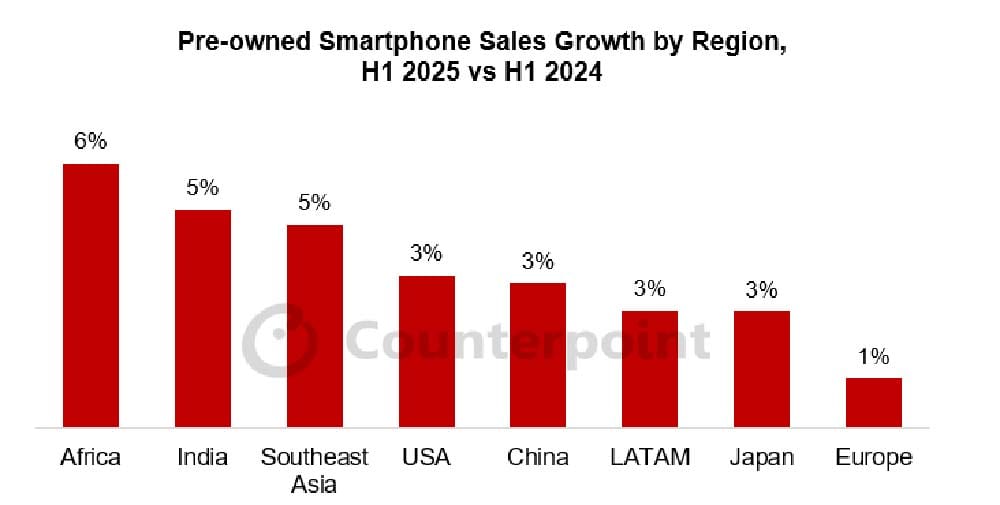

According to the latest data drop from Counterpoint Research, the worldwide market for preowned smartphones is in a full-blown transition. While the usual tech heavyweights — Europe, the United States, and Japan — are flatlining with a yawn-inducing 1% to 3% growth, the real surge is being powered by the emerging world. Regions like Africa, India, and Southeast Asia are now collectively shouldering the responsibility for global momentum.

Emerging markets are clocking an average of 4% year-on-year growth, with Africa leading the charge at a blistering 6% and both India and Southeast Asia right behind with a powerful 5% YoY leap in the first half of 2025.

The ‘premiumization’ play in Southeast Asia

While Africa took the top spot for sheer growth, the story unfolding across the bustling markets of Southeast Asia is arguably the most telling. The region’s 5% surge hints at a tectonic shift in how millions of consumers are defining value.

SEE ALSO: Apple still rules premium phones, but HUAWEI, Google, Xiaomi are gaining speed and Top 10 best-selling smartphones of Q2 2025: Apple, Samsung leave little room for rivals

Historically, Southeast Asia’s massive preowned ecosystem was often dominated by large, sprawling unorganized channels, with a heavy dependency on steady inflows of used devices and components from places like China. That dependency is changing. Counterpoint’s analysis reveals that countries across the region are starting to build stronger, more localized supply chains, slowly reducing their reliance on imports. The market is professionalizing.

This professionalization is primarily being driven by two factors:

- The rise of consumer-to-consumer platforms. Online consumer-to-consumer marketplaces are becoming dominant, particularly for refurbished smartphones. Why? Because increasing consumer trust, better logistical supply chains, and the sheer digital convenience of transacting online are eroding the old, informal systems.

- The Apple takeover. When consumers in Southeast Asia look to buy a “new” used phone, they are overwhelmingly looking for the most aspirational brand: Apple. The Cupertino giant now commands a staggering half of the region’s preowned market, fueled by a powerful 15% YoY growth. The iPhone 12 and iPhone 13 series models are the go-to devices, signaling a robust premiumization trend where users are prioritizing a slightly older, high-end flagship over a new midrange model. It’s a value proposition where status and perceived reliability trump a budget price tag.

While Apple is eating up the spoils, competitor Samsung is fighting back strategically. Despite a 3% YoY decline in volume, the South Korean company is doubling down on active trade-in programs, including key partnerships like the one with Laku6, part of the Carousell Group. This is seen as a necessary move to boost after-sales engagement, encourage upgrades, and ultimately, feed its own supply chain with devices for their Certified Pre-Owned programs.

Emerging markets: The new engine room

The Sotheast Asia growth story is mirrored, but slightly different, in its counterparts:

- Africa (6% YoY growth). The highest climber. Its growth is primarily driven by organized players pulling volume from informal channels and supportive government programs like the Bridge by Digital Africa initiative. Like in Southeast Asia, imported used iPhones are a massive hit, perceived as more reliable and long-lasting than new local units.

- India (5% YoY growth). Organized retail channels here are aggressively marketing a premium image for refurbished devices. This market is shifting fast, with consumers specifically hunting for recent premium smartphones. The result? Apple’s preowned sales skyrocketed by 19% YoY, driven by the popularity of the iPhone 13 and iPhone 14 series.

The stalled-out North

Meanwhile, the established markets are experiencing the tech equivalent of a slow, foggy day. The U.S., Japan, and Europe largely remained flat, tempering global growth. Why? Market saturation, longer consumer replacement cycles, and limited supply of devices — because fewer are being traded in, and export flows to emerging markets are shrinking.

These markets are shifting focus from volume to circularity. In the U.S., operators and retailers are strengthening buy-back schemes. In Europe, despite rising operational costs, competition has led to an increase in trade-in schemes. Japan is seeing a steady growth in consumer trust for CPO devices sold directly by major carriers. Here, the focus is on maintaining a healthy ecosystem, with the iPhone 12 and iPhone 13 series continuing their reign as the top-selling used devices.

The takeaway

It’s clear the global used smartphone market is no longer a dumping ground for aging electronics. It is a vital, premiumization-driven ecosystem where consumers in fast-growing regions like Southeast Asia are making a calculated choice for quality and brand status.

For OEMs and retailers, the message is simple: The next frontier for growth isn’t just about selling a new device;, but also about owning the entire lifecycle, from trade-in to refurbishment and resale. The 5% leap in Southeast Asia shows that whoever best organizes this chaotic, highly aspirational market will be the one setting the pace for the next wave of global smartphone adoption.

Share this Post