A massive bill is sweeping through the Philippines, aiming at the country’s most relentless enemy: corruption.

The Philippine National Budget Blockchain Act is a piece of legislation designed to bring radical transparency to government spending using the very same technology that powers Bitcoin — the blockchain. The bill, championed by Sen. Paolo Benigno “Bam” Aquino IV, has already secured wide political backing.

So, what is a blockchain? Think of it like a massive, shared Google Sheet that lives on thousands of computers instead of just one. When a transaction happens — say, the release of budget funds — that data is grouped into a block, encrypted, and added to the end of a chain. Once the block is linked, it’s secured by cryptography, making it practically impossible to alter or delete without everyone on the network instantly knowing.

What the Philippine Blockchain Bill is all about

At its core, Senate Bill No. 1330 proposes one huge, foundational system — a National Budget Blockchain System. This system would track public funds from the moment they are approved in the General Appropriations Act (GAA) all the way to final disbursement and audit.

The entire operation revolves around a concept called Digital Public Assets. This is the mechanism that makes the data real. Every budget-related record — from appropriations to actual expenses — gets permanently logged as a DPA. This gives the information legal weight and makes it virtually tamper-proof.

Of course, making a national-scale blockchain system a reality requires significant government oversight. Specifically, it requires the direct cooperation of a three-agency team.

First up is the DICT (Department of Information and Communications Technology). Think of them as the chief engineers. They’re tasked not just with setting up a few servers, but with constructing and maintaining the entire blockchain infrastructure, or “rails,” that the nation’s budget will run on. That’s a monumental ask, requiring a stable, secure, and nationwide digital foundation.

Next is the DBM (Department of Budget and Management), which steps into the role of the data warden. Their job is the painstaking work of integration: feeding all the existing, and often messy, financial systems into the new blockchain. They are the gatekeepers who must ensure every peso of expenditure data is correctly published as a DPA. If the data going in is clean, the whole system works; their role is arguably the most critical for data integrity.

Finally, we have the COA (Commission on Audit). As the country’s primary surveillance body, the COA is the primary beneficiary of this bill. Local auditors gain a powerful, real-time advantage in the form of an immutable ledger that replaces mountains of paper and months of back-and-forth verification.

Currently, the COA spends years on audits. With the blockchain, verifying financial flows could take days. It switches auditing from a slow, reactive cleanup to a proactive, preventative security layer.

Beyond the immutable ledger and agency oversight, the bill introduces Smart Contracts, which are basically just self-executing lines of code. They automatically release funds only when verifiable milestones are hit, like a project passing an inspection or specific procurement requirements being met. This creates a technical barrier against manual manipulation.

But perhaps the bill’s most potent weapon against corruption lies in the establishment of a mandatory, publicly accessible digital portal. This feature effectively deputizes Filipinos into impromptu, real-time auditors. No longer must the public rely on delayed annual reports; citizens can now track every single peso from its initial allocation in the national budget to the specific project it funds and its final recipient. This level of granular, transparent monitoring shines a flashlight on the darkest corners of government operations, making it much easier to spot potential irregularities such as overpricing, scope manipulation, or engagement with shady contractors.

For agencies like the DPWH (Department of Public Works and Highways), which have a history burdened by recurrent scandal and project overruns, this provision represents a fundamental institutional shift. By placing financial flows under constant public scrutiny, the bill transforms oversight from a bureaucratic, internal process into a dynamic, external deterrent.

What the bill is not

Let’s get the inevitable confusion out of the way: When most people hear “blockchain,” they think Bitcoin and other cryptocurrencies. This bill has nothing to do with that.

It is explicitly not about regulating speculative digital coins or NFTs. This legislation is only harnessing the blockchain’s core strengths — security, transparency, and immutability — and completely side-stepping the volatile world of trading. It also keeps it separate from the Philippines’ main finance watchdogs, like the Securities and Exchange Commission (SEC), which focuses on investor protection and money laundering.

At the recent Blockchain Bill hearing, experts were quick to point out that the use of blockchain technology isn’t a silver bullet, citing the “Garbage In, Garbage Out” problem. If a corrupt official logs fraudulent data before it hits the blockchain, the system will only faithfully record the lie; it can’t fix it. Ultimately, the bill’s success will largely depend on stricter laws and a genuine intent to feed it clean data.

Local prototypes, global precedent

The good news is that the vision of SBN 1330 isn’t just hot air. As you’re reading this, various government agencies are already testing the waters.

The DBM currently operates a public portal that uses blockchain to record key budget-release documents. The agency is tokenizing key documents, such as Special Allotment Release Orders (SAROs) and Notices of Cash Allocation (NCAs), into Non-Fungible Tokens (NFTs) to prevent any unauthorized changes.

Recently, the DPWH partnered with the Blockchain Council of the Philippines (BCP) to launch the Integrity Chain. This platform tracks Foreign Assisted Projects and uses external validation, where NGOs, media, and universities act as independent checkpoints for milestones and budgets.

These successful proofs-of-concept fundamentally shift the legislative debate. The question is no longer if the technology works, but how to standardize and scale these scattered experiments into a cohesive, single national system.

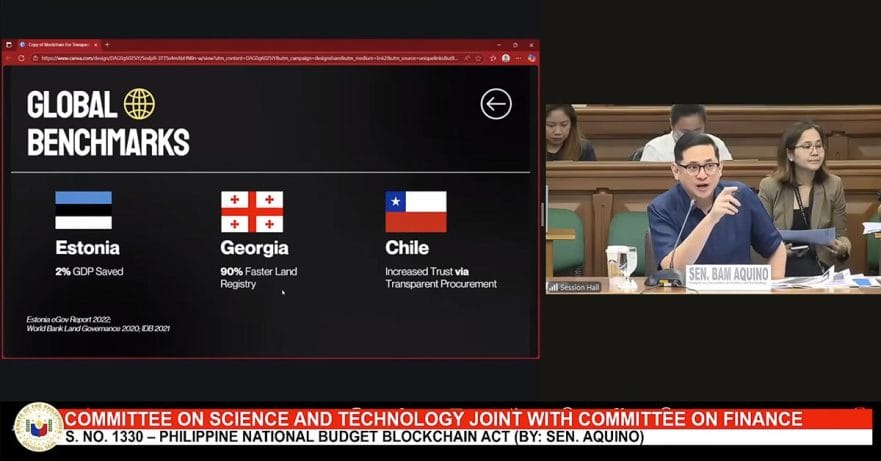

As for global precedents, the closest and most recognizable parallel is arguably Estonia’s e-Estonia. The country uses blockchain technology — specifically, its own Guardtime KSI Blockchain — to secure the integrity of government data across virtually all public services, from healthcare and banking to voting and even law enforcement.

And while its success offers a crucial lesson for the Philippine Blockchain Bill, its experience also demonstrates that the commitment to high-quality data input and robust governance structure is equally important. Estonia built its blockchain on top of a foundation of strict digital identity management and clear regulatory frameworks, proving that policy discipline and political will must precede technology for any system designed to enhance government accountability.

Share this Post