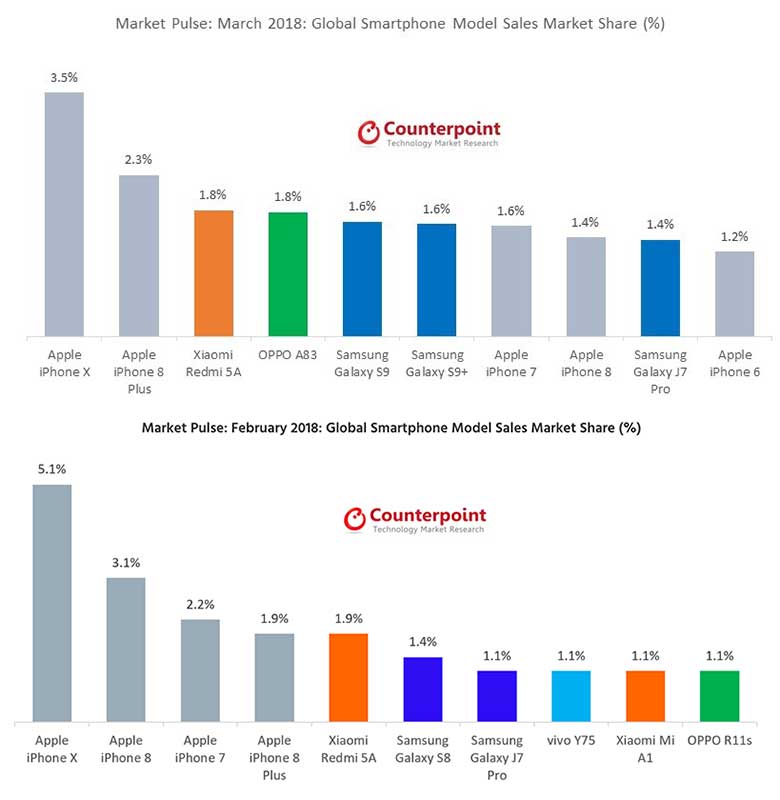

Which smartphones ruled the global sales chart in March 2018? Were they the same devices that people bought in February?

According to market-research firm Counterpoint’s latest Market Pulse report, the Apple iPhone X remained the No. 1 choice of consumers worldwide despite its high price. It captured 3.5 percent of the market, a nice way to cap off the quarter it convincingly dominated — the same result another research company, Strategy Analytics, reported weeks ago. With all this being said, the choices of phones would differ in various categories. For example, you may find the iPhone X may not be a good contender if you’re after high quality shockproof smartphones. We all have our personal preference when it comes to finding the smartphone that’s right for us.

SEE ALSO: What many thought about the Apple iPhone X was wrong

At second place was the iPhone 8 Plus with a 2.3 percent market share, which climbed two spots in March because of a push from Apple during that period.

The Apple iPhone X remained the No. 1 choice of consumers worldwide, followed by the Apple iPhone 8 Plus. The Xiaomi Redmi 5A, on the other hand, was the bestselling Android in March.

The Redmi 5A, currently the cheapest Xiaomi phone that’s officially available in the Philippines at P4,390 (around $84), entered the top three as it became the third bestselling handset in the world. It was the No. 1 Android device, followed by the OPPO A83 and the Samsung Galaxy S9 and Galaxy S9+ The success of the Redmi 5A is sign of growth amongst budget smartphones. This isn’t just occuring in the Phillipines, but also we are seeing a rise of budget smartphones in India. You might find it beneficial to check out some reviews on these phones if you are interested in purchasing one. .

READ ALSO: OPPO A83 review: The most recommendable OPPO phone yet

The Apple iPhone 7, iPhone 8, and iPhone 6 took the seventh, eighth, and 10th positions with 1.6 percent, 1.4 percent, and 1.2 percent market shares, respectively. At ninth place was the Samsung Galaxy J7 Pro, which was launched in the Philippines in July 2017 for P15,990 ($305).

You can see the most recent monthly ranking versus the one in February below.

These were some of the highlights of Counterpoint’s Market Pulse report:

- Samsung doubled its share in the premium segment, but faced tough competition in the mid- and low-end categories from Chinese manufacturers OPPO, Vivo, Huawei, and Xiaomi.

- The market share of budget smartphones slightly increased after good performances from Xiaomi, Samsung, and some of the local brands in India, Southeast Asia, and Africa.

- Capturing almost half the $100-$199 (P5,240-P10,427) price band, Xiaomi, Samsung, and Huawei’s Honor sub-brand helped drive the uptick in the price-category volume in markets like India and Southeast Asia.

- Expect a small increase in the mid-tier price-band share after a marketing push from OPPO, Vivo, and Huawei in China and India.

Share this Post