Philippine Savings Bank, the thrift banking company under the Metrobank Group, has unveiled PaSend for its customers who need to send money to other people instantly.

The new PaSend service allows PSBank depositors to conveniently and securely wire money to anyone at any time — day or night — using the PSBank app for mobile devices.

SEE ALSO: PSBank shows efficiency in 1-day home-loan application approval process

The transferred funds can be withdrawn from any PSBank or Metrobank ATM nationwide. Additionally, the service is priced competitively compared with other domestic wire-transfer platforms and does not require recipients to have a PSBank or Metrobank account.

We understand that you might have additional questions about this platform, which is why we’ve come up with this FAQ to answer some of your questions.

How do you use PaSend to send money?

Download and install the PSBank app on your device. Log in, then select the PaSend option from the menu.

Choose your PSBank account, specify the amount to be transferred, nominate a four-digit PIN (PIN 1) for security, then indicate the name and mobile number of the person who will receive the money.

Wait for a one-time PIN to be sent to your device, and type in the PIN.

A system-generated six-digit PIN (PIN 2) will be sent to the phone of the person receiving the transfer, along with the funds. This PIN is valid within 12 hours from the time of the transaction request.

Send the PIN 1 you nominated to the person getting the funds; he or she will need it to withdraw the money you sent via PaSend from the ATM.

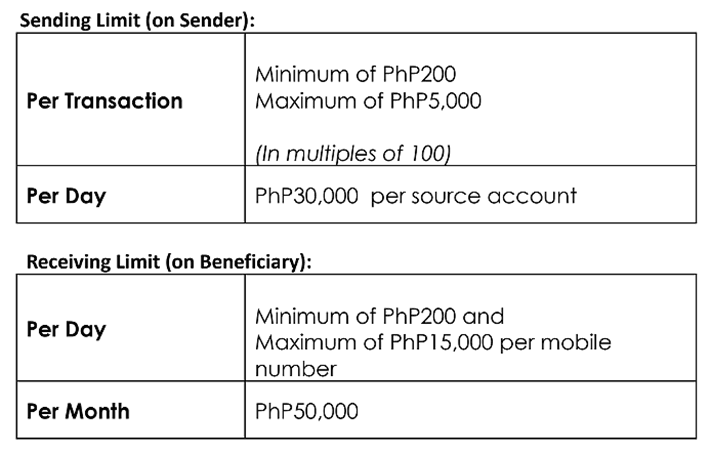

Is there a limit to the amount that you can send and your beneficiary can receive?

Yes. Refer to this table for the specific transaction limits.

Transaction limits you and your beneficiary need to remember

How many PaSend transactions can you make every day?

You are allowed multiple transactions, provided the total amount sent will not exceed the daily limit of P15,000 per account.

What is the minimum amount you can transfer?

The minimum transaction is P200.

Is there a service fee for PaSend?

Yes, P25 per transaction, to be paid by the sender. An additional fee of P7.50 will be collected from the sender if the funds are withdrawn from a Metrobank ATM.

How will you know if the person has withdrawn the funds?

Email and SMS notifications will be automatically sent to you once the funds have been withdrawn.

Can you cancel a PaSend request?

Yes, but only incomplete requests, where the funds have not been withdrawn, can be cancelled.

How do you cancel a request?

Open the PSBank app on your device. Select PaSend, choose Cancel Requests, then tap the “X” icon beside the transaction you wish to cancel. Alternatively, you can call the PSBank customer service hotline at +632.845.8888.

Can you change the recipient of the funds?

No. But you may cancel a pending request, then create a new one for the new recipient. If you cancel a request, the service fee won’t be refunded.

How soon can the recipient withdraw the funds?

The individual can withdraw the money as soon as he or she receives the four-digit PIN (PIN 1) from you and the system-generated SMS containing the six-digit PIN (PIN 2) and amount.

What should the recipient do if he or she gets an error message on the ATM screen?

The sender must inform you immediately, so you can call the PSBank hotline. Your beneficiary can also call the hotline himself or herself. The person can likewise try another PSBank or Metrobank ATM.

What will happen if the recipient enters the wrong PIN or wrong amount three times?

After three invalid attempts in the ATM, the PaSend request will be automatically cancelled by the system. An SMS notification will be sent indicating that the request has been cancelled.

Can the recipient withdraw an amount lower than the amount requested?

No, partial withdrawal is not allowed. The amount indicated in the app and SMS notification should be the actual amount withdrawn in the ATM.

Share this Post