Estimated reading time: 3 minutes

If you’re running low on cash and the next payday isn’t until a couple of weeks, Grab has something you might want to try out. Assuming you qualify for it, of course.

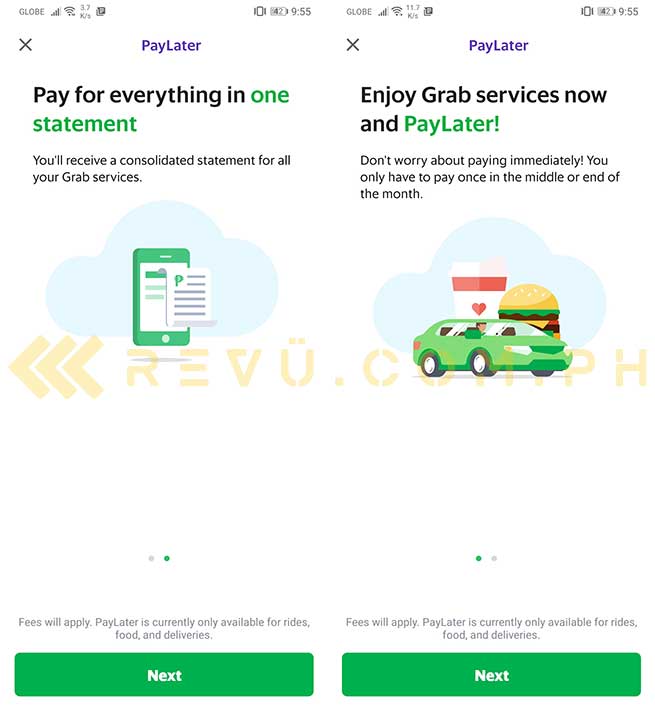

Grab is currently rolling out its new PayLater feature in the Philippines, which will allow users to continue using Grab services, including GrabCar, GrabTaxi, GrabFood, GrabMart, and GrabExpress, then pay for them later in one monthly bill. So yes, it’s a credit line specifically for Grab customers who don’t already have their own credit lines from banks. And as expected, the way you settle your bill is through your GrabPay balance.

This feature should show up in the app as a new payment method; however, not all users will be able to take advantage of it. According to Grab’s local arm, PayLater will only be available to “top-tier and longtime Grab users who regularly use the app’s features and those with significant transactions across the app’s different services.”

The company doesn’t say anything more about how a user can be granted access to PayLater, but it seems that it can only be accessed by users with a Platinum GrabRewards tier. We don’t have a Gold account, so we don’t know if that’s enough to qualify for the service. A Silver membership probably won’t cut it.

A customer has to click and subscribe to activate PayLater in their account. Grab will then set a pre-approved limit for a monthly PayLater spend. This limit will be refreshed upon settling your latest bill. Your PayLater bill will be generated on the 1st or 15th of the month depending on the activation date, and you’ll be given seven days to pay for it.

What’s nice about PayLater is that Grab won’t charge you any interest for using the service. However, do take note that every consolidated bill will come with a pretty hefty 3.99% processing fee tacked onto it.

You can visit this page on the company’s website to get a computation of how much you will pay given a certain level of spending. We suggest you track your transactions within the app to avoid bill shock. You can also enable notifications to receive payment alerts to help you avoid late fees. An additional late fee of 3.99% will be charged if you miss your due date. Ouch, that’s almost 8% of your monthly spend.

Share this Post