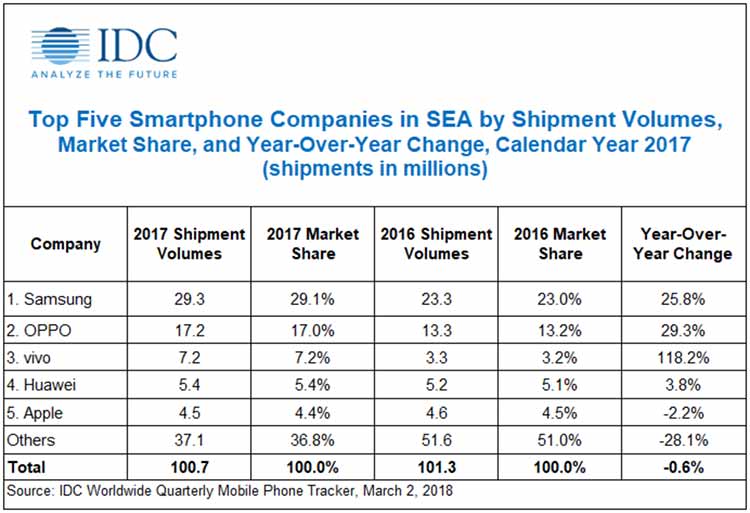

The latest International Data Corporation numbers for Southeast Asia are in.

The market-research firm has revealed last year’s top five smartphone companies in the region based on the number of devices they had shipped. And while we see the usual suspects on IDC’s list, the ranking is quite different from that worldwide, where you normally see Samsung, Apple, and Huawei in the pole positions as of late.

SEE ALSO: Xiaomi lands in top 5 of world’s largest smartphone companies

In Southeast Asia, only the Korean tech giant was able to maintain its (No. 1) standing. OPPO and Vivo beat Apple and Huawei to take the second and third spots. This is what the 2017 smartphone industry is in a nutshell:

There were three smartphone-market highlights last year:

- Low-end devices’ market share was still the largest at 37 percent. But the more interesting detail? Shipments of midrange handsets grew an astounding 53 percent — from 17 percent in 2016 to 27 percent in 2017 — year-on-year, driven by the top five players: Samsung with its J series and OPPO, Vivo, and Huawei with their F, V, and Nova lineups, respectively. Apple’s presence in the mid-end category, on the other hand, was represented by its older models, mainly the Apple iPhone 5, iPhone SE, and iPhone 6.

- 4G smartphones finally became a norm last year, what with a 44 percent year-on-year growth — from 56 percent in 2016 to 81 percent in 2017.

- Southeast Asians’ screen-size preference changed in favor of phablets, or those whose displays measure at least 5.5 inches but less than 7 inches. Phablet shipments increased from 20 percent in 2016 to 35 percent in 2017, representing a whopping 71 percent year-on-year growth. This development was spurred by the ongoing change in media-consumption habits and the introduction of smartphones with slim bezels. Samsung recorded the largest shipments, while China’s Vivo accounted for the highest growth in this category.

What will 2018 be like? According to IDC senior market analyst Jensen Ooi, “Local vendors will continue to feel the impact as end-users gradually shift their preference to more popular brands and are more willing to invest in their upgrade to larger-screen midrange smartphones.”

For the local companies (the Philippines’ Cherry Mobile, for example) to stay competitive, Ooi expects them to ship more devices with features like dual cameras, thin bezels, and on-device artificial intelligence.

SEE ALSO: What Android Go is, and why you should care

“They will introduce handsets that come with Android Oreo ‘Go edition’ while keeping the price affordable at less than $200 (roughly P10,400) to suit the budget requirements of their local target segments,” adds Ooi.

Main image via Independent

Share this Post